Posted on: Thursday, February 25, 2021

At 6.9% and 7.0% respectively, average annual price growth in the West Midlands and Wales is slightly lower than the UK average. In the West Midlands growth is currently stronger than at any point since summer 2016, in Wales since before the Global Financial Crisis. In eleven areas growth currently exceeds 7.5%. Although Rightmove report a slight fall in asking prices month on month, properties are selling more quickly than a year ago.

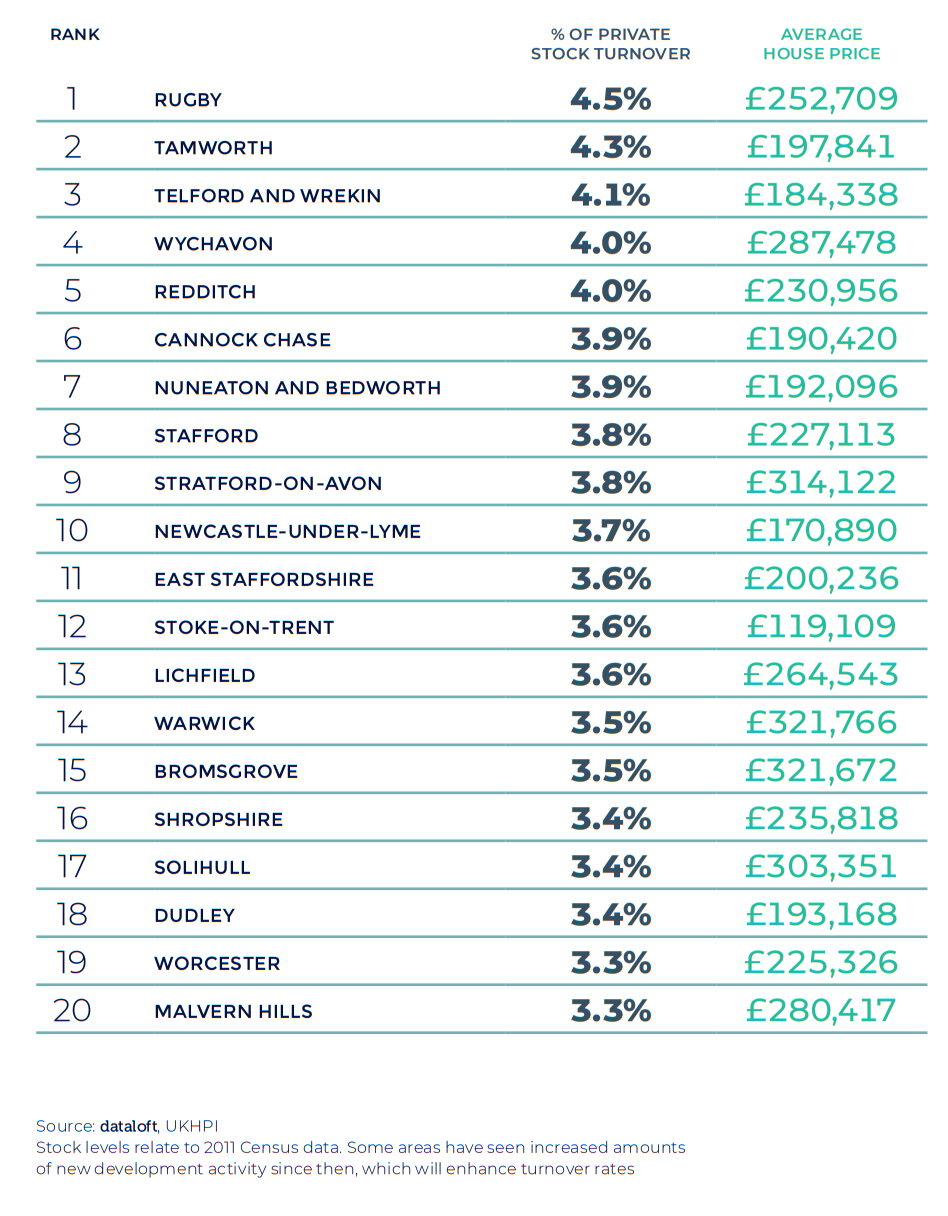

Average property prices in the West Midlands and Wales are more expensive than a year ago and activity across the market is robust. On average 3.3% of private properties are sold each year, with turnover in five areas currently 4% or above. Over 15,400 new homes were registered for sale during 2020, and nationally registrations have been on an upward trend since September.

First-time buyers were particularly affected by the closed housing market and the stricter mortgage lending that followed. However, buyer numbers have recovered steadily, with transactions just 2% lower year on year during the final six months of 2020 (UK Finance). The number of High Loan-to-Value (LTV) mortgage products has also increased, Moneyfacts reporting there were 169 products available at 90% LTV in January, over double the number available back in July. Lending rates remain low, the average mortgage rate the lowest in history.

If you want independent guidance on moving home or are looking for the best agent in your area, find your local Guild Member today.

We are required by law to conduct anti-money laundering checks on all those selling or buying a property. Whilst we retain responsibility for ensuring checks and any ongoing monitoring are carried out correctly, the initial checks are carried out on our behalf by Lifetime Legal who will contact you once you have agreed to instruct us in your sale or had an offer accepted on a property you wish to buy. The cost of these checks is £60 (incl. VAT), which covers the cost of obtaining relevant data and any manual checks and monitoring which might be required. This fee will need to be paid by you in advance of us publishing your property (in the case of a vendor) or issuing a memorandum of sale (in the case of a buyer), directly to Lifetime Legal, and is non-refundable. We will receive some of the fee taken by Lifetime Legal to compensate for its role in the provision of these checks.